Some Known Incorrect Statements About Home Appliances Insurance

The Basic Principles Of Home Appliances Insurance

Table of ContentsHome Appliances Insurance Things To Know Before You Get ThisFacts About Home Appliances Insurance RevealedHow Home Appliances Insurance can Save You Time, Stress, and Money.The Best Strategy To Use For Home Appliances InsuranceEverything about Home Appliances InsuranceHome Appliances Insurance - The Facts

Certified guarantee companies have a Construction Professionals Board (CCB) permit number. We can verify that number for you. Provide us with duplicates of correspondence or documentation you get from the firm so we can aid them follow the regulation.Have you ever wondered what the difference was in between a home service warranty as well as home insurance policy? Both protect a residence and a homeowner's wallet from costly repair work, however what exactly do they cover? Do you need both a house warranty and also house insurance coverage, or can you get simply one? All of these are excellent concerns that many home owners ask.

What is a house service warranty? A residence warranty secures a home's interior systems and also appliances. While a house warranty contract is comparable to residence insurance coverage, especially in exactly how a homeowner uses it, they are not the exact same point. A homeowner will certainly pay an annual premium to their home guarantee firm, generally in between $300-$600.

10 Simple Techniques For Home Appliances Insurance

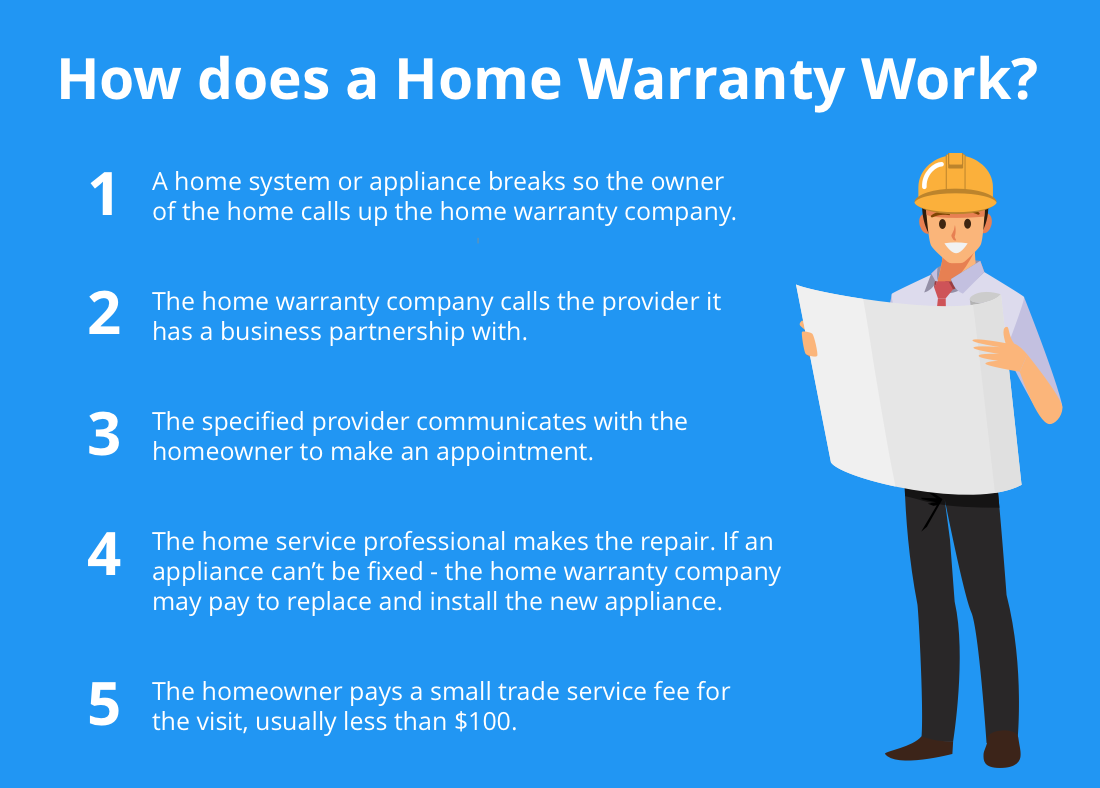

If the system or home appliance is covered under the home owner's residence service warranty plan, the home service warranty business will send out a specialist who specializes in the fixing of that certain system or appliance. The home owner pays a level rate service call cost (normally in between $60-$100, depending on the residence guarantee company) to have actually the service provider involved their house and identify the problem.

What does a residence service warranty cover? A house guarantee covers the main systems in a home, such as a home's heating, air conditioning, plumbing, as well as electrical systems. A residence warranty might likewise cover the larger devices in a house like the dishwasher, stove, refrigerator, garments washer, and also dryer. House warranty firms typically have various plans offered that provide coverage on all or a choose few of these things.

The Best Strategy To Use For Home Appliances Insurance

Home insurance policy may also cover clinical expenses for injuries that people suffered by being on your residential or commercial property. When something is harmed by a disaster that is covered under the residence insurance policy, a home owner will call their house insurance coverage company to submit a case.

Property owners will usually have to pay an insurance deductible, a fixed quantity of money that comes out of the home owner's budget before the residence insurance provider pays any kind of money in the direction of the claim. A house insurance coverage deductible can be anywhere between $100 to $2,000. Normally, the higher the insurance deductible, the reduced the annual costs this price.

What is the Difference Between House Warranty and House Insurance Policy A home warranty agreement and a house insurance plan operate in similar means. Both have a yearly premium and also an insurance deductible, although a residence insurance coverage costs as well as insurance deductible is usually a lot more than a residence service warranty's. The primary distinctions between house warranties as well as home insurance are what they cover (home appliances insurance).

A Biased View of Home Appliances Insurance

If there is damages done to the structure of the house, the proprietor won't need to pay the high costs to fix it if they have house insurance coverage (home appliances insurance). If the damage to the residence's framework or property owner's belongings was caused by a malfunctioning home appliances or systems, a house service warranty can aid to cover the pricey repair services or replacement if the system or device has failed from regular wear and also tear.

They will collaborate to supply protection on every component of your home. If you're interested in acquiring a residence guarantee for your house, take an appearance at Landmark's home warranty plans as well as pricing below, or request a quote for your house here (home appliances insurance).

See This Report on Home Appliances Insurance

"Nonetheless, the a lot more systems you include, such as pool coverage or an additional home heating system, the higher the expense," she claims. Adds Meenan: "Prices are usually flexible too." In addition to the yearly cost, property owners can anticipate to pay visit this web-site generally $100 to $200 per solution call go to, relying on the type of contract you get, Zwicker notes.

"We paid $500 to join, and afterwards had to pay an additional $300 to clean the major sewer line after a shower drainpipe back-up," claims the Sanchezes. With $800 out of pocket, they thought: "We really did not benefit from the house warranty in any way." As a young pair in an additional residence, the Sanchezes had a hard experience with a house warranty.

The Best Guide To Home Appliances Insurance

When the specialist wasn't pleased with a reading he obtained while checking the heater, they state, the company would not this accept protection unless they paid to replace a $400 part, which they did. While this was the Sanchezes experience years back, Brown confirmed that "evaluating every significant device prior to offering protection is not a market criterion."Always ask your carrier for quality.